b&o tax credit

Get an extra 500 BO tax credit if the employee that fills the new position is a Tacoma resident. Dditional credits are available of up to 1000 every year.

B Amp O Tax Guide City Of Bellevue

Members of Wheeling City Council now will vote in early February on a one-time BO Tax credit program for small businesses that was approved by the citys Finance Committee early this evening.

. Get an extra 500 BO tax credit if the employee that fills the new position is a Tacoma resident. Syrup must be used by the buyer in making carbonated drinks. The Washington State Department of Revenue Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to Main Street Coupeville Historic Waterfront Association.

71 for monthly taxpayers 211 for quarterly taxpayers and 841 for annual tax payers. Take the credit against your Tacoma BO taxes each year and attach aJob heet. Laurie Miller Neighbor Posted Fri Nov 2 2012 at 447 pm PT Updated Fri Nov 30 2012 at 739 pm PT.

BO Tax Credit Program Direct your tax dollars back into your community Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community. This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451. B O Tax.

Beginning October 1 2016 businesses that hire unemployed veterans may qualify for credit against their State business and occupation BO tax or public utility tax PUT. A Business and Occupation BO tax credit is provided to businesses that make a contribution used for the development and operation of a downtown or neighborhood commercial district revitalization program. Dditional credits are available of up to 1000 every year.

The tax credit is based on 75 percent of the. The credit equals 20 percent of the wages and benefits a business pays to or on behalf of a qualified employee up to a maximum of 1500 for each qualified employee hired. BO Tax Credit Program.

Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution you have made to the Alliance on your. A business and occupation BO tax credit is available to businesses that employ an unemployed veteran in a permanent full-time position located in Washington for at least two consecutive full calendar quarters on or after October 1 2016 and before June 30 2022. By exempting firms with up to 125000 in gross receipts from the Business Occupations Tax BO and expanding the Small Business Tax Credit to those enterprises earning nearly 250000 annually Senate Bill 5980 will provide welcome relief for some 276000 small businesses.

However your business may qualify for certain exemptions deductions or credits. 50 or more of your taxable income was reported under Service and Other Activities Gambling Contests of Chance For-Profit Hospitals andor Scientific RD and. Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax.

Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. Direct your tax dollars back into your community.

Make a pledge of as little as 1000 beginning January 11 2022 to Sumner Main Street Association pay the pledge to SMSA by November 15th and 75 of your pledge will be deducted from your. The Main Street Tax Credit Incentive Program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. HB 1914 raises the states BO tax credit from 35 million to 15 million per calendar year more than four times the programs amount.

Get an extra 250 BO tax credit if the position meets the definition of a. Maycumbers legislation prioritizes small businesses serving rural and. The credit increases each year.

In order to take advantage of those dollars the state can offer a small BO tax credit which encourages donations to the 29 CDFIs operating in Washington state. BO Tax Credit for Syrup Tax Paid Credit ID 945 A retailing business that pays syrup tax when buying carbonated beverage syrup to make carbonated fountain drinks can claim a BO tax credit as of July 1 2006. The amount of small business BO tax credit available on a tax return can increase or decrease depending on the reporting frequency of the account and the.

Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community. The BO tax for labor materials taxes or other costs of doing business. Take the credit against your Tacoma BO taxes each year and attach a Job Credit Supplemental Information Sheet.

Market Vines is a popular destination at Centre Market. The following requirements must be met in order to take this BO tax credit. Get an extra 250 BO tax credit if the position meets the definition of a.

Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization. The Main Street Tax Credit Incentive Program provides a Business Occupation BO tax credit for private contributions given to your local Main Street organization the Downtown Waterfront Alliance. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year.

There are two credits available under the Small Business Tax Credit depending on your taxable income and total BO tax liability. Wheeling Finance Committee Approves BO Tax Credit. The proposal would allow small businesses with fewer than 25.

The Small Business Tax Credit 720 applies if. If youre in the manufacturing category you wont have to pay B O tax until your annual income is at about 86000 with a sliding scale after that. New BO Tax Credit.

It adds special incentives for small production companies and productions that tell the stories of marginalized communities. The small business tax credit is broken up based on how often you file as follows. This credit is commonly referred to as the small business BO tax credit or small business credit SBC.

For example if you extract or manufacture goods for your own use you owe BO tax. B O Tax Credit Incentive Program Benefits Your Business and the Sumner Downtown Association.

Main Street Tax Credit Program In Washington

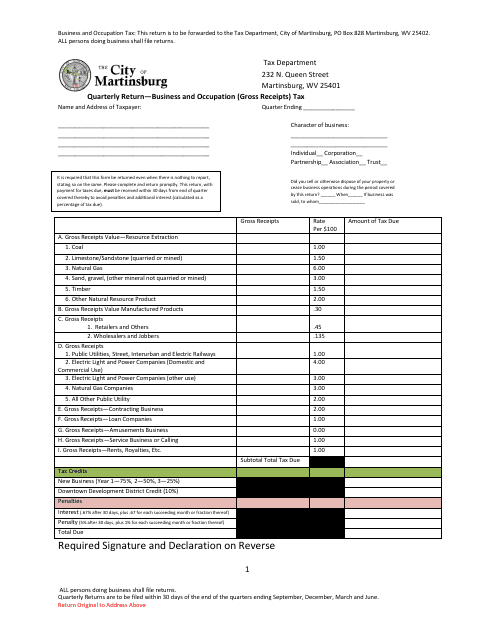

West Virginia Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

Apple Iphone 6 16gb Gsm Unlocked Space Gray Used Ting Sim Card 30 Credit Walmart Com Apple Iphone 6 Prepaid Phones Apple Iphone

The Classic Harpist June 2011 Beautiful Outdoor Wedding Rustic Barn Wedding Outdoor Ceremony

Business And Occupation B O Tax Washington State And City Of Bellingham

Baltimore And Ohio Railroad Museum Baltimore And Ohio Railroad Museum Ohio

9712 Fairbanks Morse H12 44 Baltimore And Ohio Railroad Train Photography Train

B O Tax Credit Program Puyallup Main Street Association

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

B Amp O Tax Return City Of Bellevue

B O Tax Credit Incentive Program Downtown Waterfront

B O Tax Credit Program Sumner Main Street Association

B Amp O Tax City Of Bellingham

A Guide To Business And Occupation Tax City Of Bellingham Wa